(The Center Square) – Democratic state legislators are again pushing a measure to change the state’s flat income tax to one with higher rates for higher earners.

Introduced by state Sen. Robert Martwick, D-Chicago, Senate Joint Resolution Constitutional Amendment 4 would formally replace language in the Illinois Constitution to allow for a so-called graduated tax system.

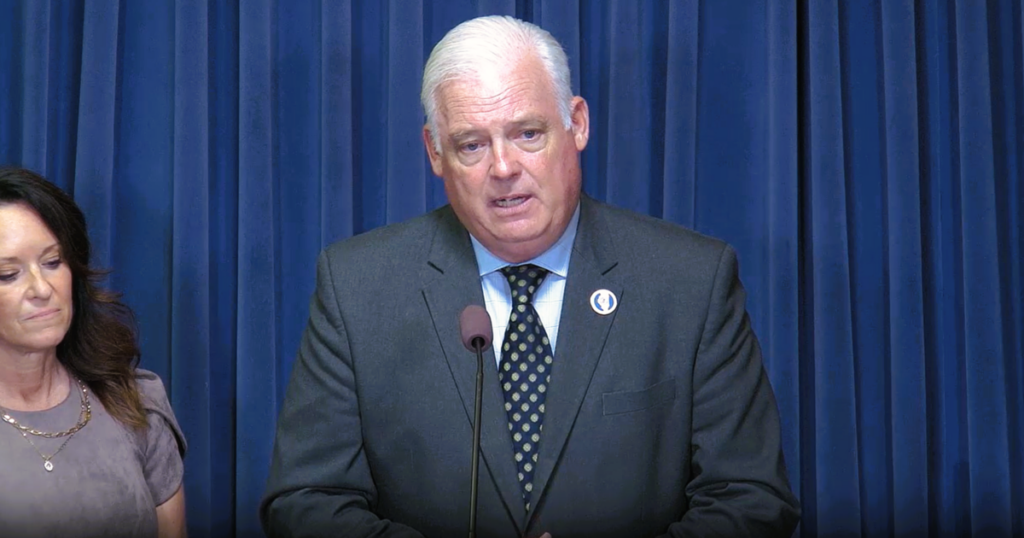

State Rep. Martin McLaughlin, R-Barrington Hills, didn’t hold back in his criticism of the idea.

“I know the progressive tax push will be as welcome by people in Cook County as another unqualified Bears head coach would be,” McLaughlin told The Center Square. “To revisit a progressive tax when we have half the growth of our surrounding states, it’s exactly the wrong idea at the wrong time.”

Martwick’s proposal comes just four years after voters roundly rejected a similar proposal despite Gov. J.B. Pritzker pumping upwards of $50 million of his own money into a campaign aimed at getting the measure over the finish line.

McLaughlin warned such a measure only sets taxpayers up for more of the kind of abuse he argued Springfield has become too well known for.

“I’m a small business owner,” McLaughlin said. “I employ people. I have to make an actual budget balance. Too many people down here in Springfield don’t have that same experience. They don’t understand that we need to be in a competitive marketplace to make Illinois prosper.”

With the latest version of the proposed amendment currently sitting in the Senate Assignments Committee, McLaughlin said virtually every taxpayer in the state has reason for concern.

“People leaving Illinois on an economic basis are wealthier than people coming to Illinois and there’s a net loss,” he said. “If you’re going to do something like this, you’re going to push business owners, families with means and those that have just decided they can’t take it anymore to move to Tennessee, North Carolina, and Texas. Our friends that have left, all we’ll be doing is sending them their next, new ex-Illinois neighbor.”

Illinois is one of 23 states to have or be in the process of implementing a flat income tax and one of only four where the tax structure is protected in the state constitution.

In 2023, Martwick filed similar legislation that would have increased tax rates from 4.95% to as high as 6.95% for some upper income residents and as low as 4% for others.