Have you ever wondered why some companies become super popular and their stocks soar like rockets? Well, in January 2025, Meta Platforms, the company behind Facebook and Instagram, saw its stock jump an amazing 18%! This exciting rise was due to a mix of cool new technology, especially in artificial intelligence, and some big news from the government. Investors were thrilled to hear that Meta expects to have 1 billion users for its AI by the end of the year! Let’s dive in to understand what made Meta shine in the stock market and what it means for the future!

| Key Points | Details |

|---|---|

| Meta’s AI Growth | Meta aims for 1 billion AI users by year-end. |

| Stock Performance | Shares jumped 18% in January after strong earnings and favorable market conditions. |

| Earnings Report | Meta reported earnings per share of $8.02, a 50% increase. |

| Market Positioning | Meta benefits from potential TikTok ban and favorable business environment under Trump. |

| AI Strategy | Meta is positioned to gain from advancements in AI and does not compete directly in cloud infrastructure. |

| Future Prospects | CEO anticipates strong growth with new products like Ray-Ban smart glasses. |

| Investment Advice | Consider potential risks; Meta not included in a top 10 stock recommendation. |

Meta’s Rise in January 2025

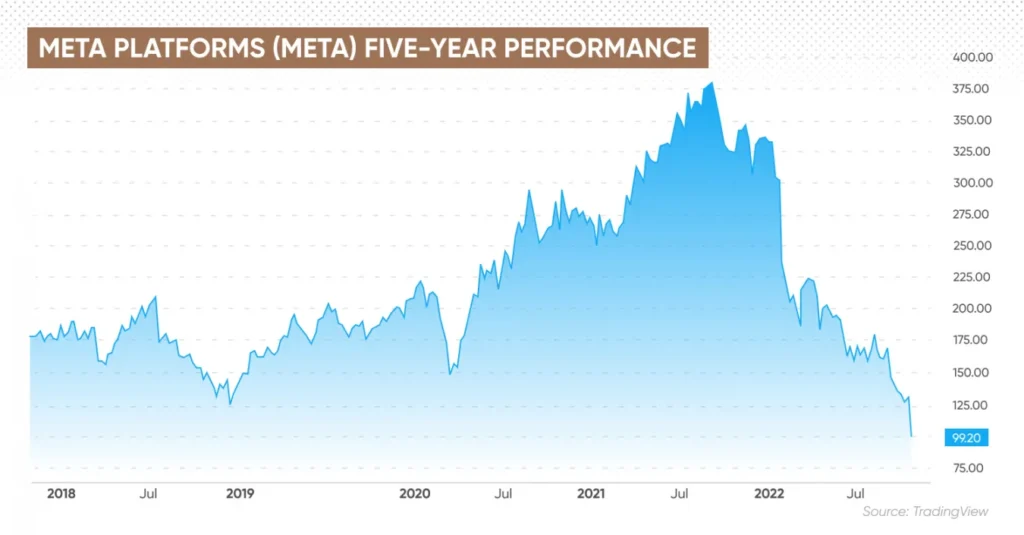

In January 2025, Meta Platforms saw a remarkable increase in its stock price, rising 18% by the end of the month. This surge was influenced by several factors, including the potential ban on TikTok, which could divert users to Meta’s platforms like Facebook and Instagram. The positive sentiment around the company was further fueled by its strong fourth-quarter earnings report, which showcased impressive growth and performance, attracting more investors.

Additionally, the inauguration of President Trump created a favorable business environment that many investors believed would benefit Meta. With expectations of possible tax cuts and less regulatory pressure, investors felt more confident in the company’s future. As a result, Meta’s stock not only gained momentum but also stood out among other tech stocks during a time of uncertainty in the market.

The Impact of AI on Meta’s Growth Strategy

Meta Platforms has strategically positioned itself at the forefront of artificial intelligence development, which has become a significant driver of its stock performance. The company’s investment in AI is not just about enhancing user experience; it’s a way to streamline operations and improve ad targeting. As Meta AI gains traction, it attracts a broader user base, which in turn boosts advertising revenue. This synergy between AI technology and user engagement is crucial for sustaining Meta’s growth trajectory.

Moreover, Meta’s commitment to AI is evident in its ambitious goal of reaching 1 billion users for Meta AI by the end of the year. This objective underscores the company’s vision of integrating AI across its platforms, making them indispensable in users’ daily lives. As AI continues to evolve, Meta is poised to leverage this technology to create innovative features that keep users engaged, thus reinforcing its market position while driving further stock appreciation.

Meta’s Financial Performance: A Closer Look

In January, Meta’s stock saw a substantial jump following its impressive fourth-quarter earnings report. The company not only exceeded analysts’ expectations but also reported a remarkable earnings per share increase of 50%. This performance is a testament to Meta’s ability to adapt and thrive in a competitive landscape, driven by its robust advertising model and increasing engagement rates across its platforms.

The financial results are particularly noteworthy in the context of broader market trends, where many tech stocks faced volatility. Meta’s resilience highlights its strategic focus on user growth and technological innovation. As the company continues to innovate and diversify its revenue streams, investors can remain optimistic about its financial health and long-term growth potential, making it an attractive option in the tech sector.

Navigating Competition in the Social Media Landscape

The competitive landscape of social media is ever-evolving, with platforms like TikTok and Snapchat constantly vying for user attention. However, Meta has shown remarkable adaptability in this arena. The recent scrutiny surrounding TikTok could position Meta as a more favorable choice for advertisers and users alike. This shift comes at a critical time, as Meta seeks to enhance its offerings to capture a larger share of the social media market.

In addition to responding to external pressures, Meta is investing heavily in its ecosystem, including features that enhance user interaction and engagement across Facebook and Instagram. By focusing on user-centric innovations and capitalizing on market opportunities, Meta is not only defending its turf but is also poised to reclaim market share from its competitors. This proactive approach is vital for maintaining its leading position in the social media landscape.

The Future Outlook for Meta Platforms

Looking ahead, Meta Platforms is set to navigate a landscape filled with opportunities and challenges. With the anticipated launch of new products, including advancements in augmented reality through Ray-Ban smart glasses, the company is well-positioned to capture the imagination of tech-savvy consumers. This innovation pipeline, combined with its growing user base, indicates that Meta is not just resting on its laurels but actively seeking to expand its influence in new areas of technology.

Moreover, the company’s strategic alignment with the current political climate may provide additional tailwinds. As the business environment becomes more favorable under the new administration, Meta could benefit from potential deregulation and tax reforms. These factors, along with its strong financial performance and commitment to AI, suggest that Meta Platforms is on a promising trajectory, making it a compelling option for investors looking for growth in the tech sector.

Frequently Asked Questions

What is Meta Platforms and what do they do?

Meta Platforms, also known as Meta, is a technology company that owns popular social media platforms like Facebook and Instagram. They focus on connecting people and developing **artificial intelligence (AI)** technology.

Why did Meta’s stock price go up recently?

Meta’s stock price increased by 18% mainly because of **strong earnings** reports, positive changes in the government, and growing interest in their AI projects, especially **Meta AI**.

What is the significance of AI for Meta?

AI, or **artificial intelligence**, helps Meta improve its services, making them smarter and more user-friendly. It’s important because it can attract more users and keep them engaged.

How many users does Meta expect for its AI assistant?

Meta aims to have **1 billion users** for its AI assistant, called Meta AI, by the end of the year. This shows their confidence in the technology and its popularity.

What are Ray-Ban smart glasses?

Ray-Ban smart glasses are special glasses made by Meta that allow users to take pictures and listen to music. They sold over **1 million units** in 2024, showing many people like them.

What does a strong earnings report mean for a company?

A strong earnings report means a company made more money than expected. For Meta, this was shown by a **50% increase** in earnings per share, which makes investors happy.

Should I invest in Meta Platforms?

Before investing in Meta, it’s important to do research. Although it’s popular, experts suggest looking at other stocks too, as there may be even better opportunities for growth.

Summary

The content discusses the significant rise of Meta Platforms’ stock, which jumped 18% in January due to various favorable factors. Key highlights include the company’s strong fourth-quarter earnings report and its expectation of reaching 1 billion users for Meta AI by year’s end. The potential ban on TikTok and a favorable business climate under the Trump administration also contributed to investor optimism. Additionally, Meta’s resilience amid industry challenges and its advancements in AI position it well for future growth, despite projected revenue slowdowns. Overall, Meta appears to be a strong contender in the tech market.