Have you ever wondered how big companies like Microsoft make money? Recently, Microsoft shared some exciting news about how well they’re doing in their second quarter! They earned more than what experts expected, but some investors were a bit worried about their cloud service called Azure. Even though Azure is growing fast, its growth was a little slower than before. This is important because Azure is a big part of Microsoft’s success. Let’s dive into what all of this means and why Microsoft is still seen as a winner in the world of artificial intelligence!

| Category | Details |

|---|---|

| Company | Microsoft (MSFT) |

| Fiscal Quarter | Q2 |

| Key Financials | Exceeded analyst estimates for revenue and earnings, but Azure growth disappointed investors. |

| Azure Revenue Growth | 31% in Q2, down from 33% in Q1, at the low end of guidance (31%-32%). |

| Total Intelligent Cloud Revenue | $25.5 billion, up 19% year-over-year. |

| AI Revenue | Surpassed $13 billion annual run rate; Azure AI revenue up 157% year-over-year. |

| Stock Performance | Shares declined; currently in slightly negative territory for the year. |

| P/E Ratio | Under 28 based on estimates for fiscal 2026. |

| Investment Outlook | Long-term investors may find opportunities to buy on the dip. |

Microsoft’s Strong Financial Performance

Microsoft recently shared its fiscal Q2 results, impressively surpassing analyst expectations for both revenue and earnings. This means they made more money than experts thought they would! This strong performance is a positive sign for the company, showing that they are continuing to grow and succeed despite some challenges. Their intelligent cloud revenue, which includes Azure, went up by 19% from last year, reaching a remarkable $25.5 billion.

Despite the overall success, not everything was perfect. Some investors were a bit disappointed with the growth rate and future predictions for Azure, Microsoft’s cloud computing service. Azure’s revenue grew by 31%, which is still strong but slower than the previous quarter. This slower growth led to a small decline in Microsoft’s stock price, even though the company is still seen as a leader in technology and a great long-term investment.

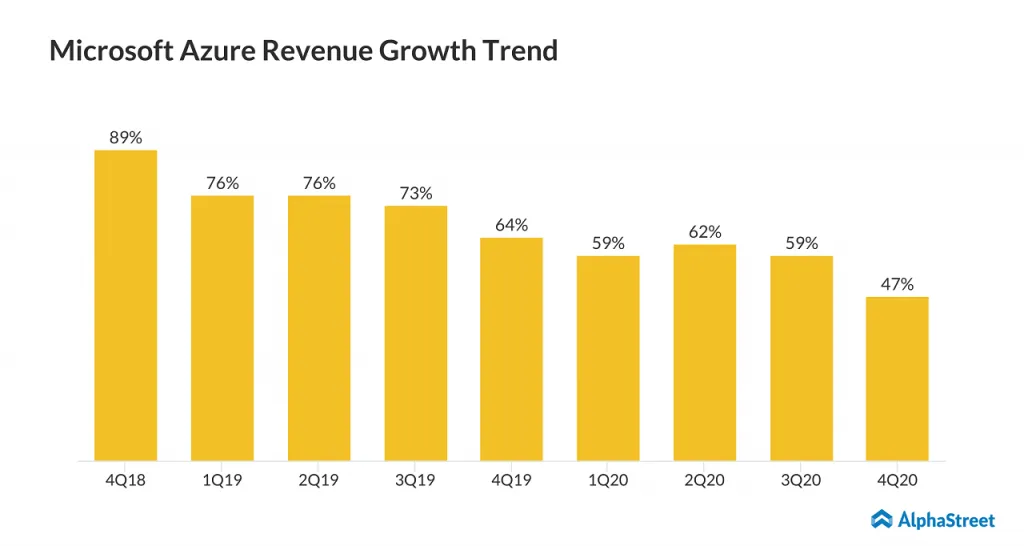

Understanding Azure’s Performance Trends

The recent earnings report from Microsoft highlighted a slowdown in Azure’s revenue growth, which is a crucial component of the company’s overall performance. Although Azure experienced a significant 31% growth in the fiscal second quarter, this marked a decrease from the previous quarter’s 33% growth. Analysts had anticipated a more robust performance, leading to some investor disappointment despite Azure remaining a primary growth driver. Understanding these performance trends is essential for investors looking to gauge the future potential of Microsoft’s cloud services.

Moreover, the Azure division’s revenue growth, while still impressive, fell at the lower end of the company’s guidance, which was between 31% and 32%. This inconsistency raises questions about the sustainability of Azure’s growth trajectory, especially as competition in the cloud computing space intensifies. However, it’s important to note that Microsoft continues to lead in innovation, particularly in AI, which could positively influence Azure’s revenue in the long term. Investors should keep an eye on these trends as they reflect both challenges and opportunities.

The Role of AI in Microsoft’s Growth Strategy

Microsoft’s strategic emphasis on artificial intelligence (AI) is crucial to its growth narrative, particularly within the Azure cloud segment. With Azure AI revenue skyrocketing by 157% year-over-year, the integration of AI technologies into Microsoft’s offerings appears promising. The company’s AI business has already achieved an annual revenue run rate of $13 billion, indicating a strong market demand for AI-driven solutions. This positions Microsoft not just as a cloud service provider but as a leader in the burgeoning AI field, which could drive future revenue growth.

As organizations increasingly adopt AI technologies, Microsoft’s innovative initiatives, such as AI Copilot in Office 365, are expected to boost customer engagement and retention. The company’s foresight in leveraging AI to enhance its software offerings positions it well for sustained growth. Furthermore, the integration of AI into Azure services can potentially lower operational costs and improve efficiency, attracting more customers to its cloud platform. Therefore, investors should view the company’s AI advancements as a critical factor in its long-term growth strategy.

Evaluating Microsoft’s Stock Valuation

Despite the dip in Microsoft’s stock price following the earnings report, the company remains an attractive investment option based on its current valuation. Trading at a forward price-to-earnings (P/E) ratio of under 28 for fiscal 2026 reflects the market’s acknowledgment of Microsoft’s strong recurring revenue streams and growth potential in AI and cloud services. Such a valuation is reasonable for a technology company that continually innovates and adapts to market dynamics. Investors might see this as an opportune moment to buy into Microsoft’s stock at a favorable price.

Moreover, the slightly negative territory of Microsoft’s stock for the year should not overshadow its robust business fundamentals. The company’s ongoing commitment to enhance its product offerings and capitalize on the AI trend suggests a resilient growth outlook. As investors assess their portfolios, Microsoft’s strong position in both cloud computing and AI indicates that it could be a long-term winner. Therefore, patient investors willing to navigate short-term fluctuations may find significant value in acquiring shares during this downturn.

Long-Term Investment Perspective on Microsoft

For long-term investors, Microsoft presents a compelling case, especially given its leadership in AI and cloud computing. While the recent earnings report may not have met all expectations, the underlying growth in AI and the potential for Azure’s resurgence should encourage investors to look beyond short-term disappointments. The tech giant’s strategic investments in AI and continuous enhancements to its cloud platform are likely to yield substantial returns over time, making it a worthwhile addition to any investment portfolio.

Additionally, as businesses increasingly integrate AI into their operations, Microsoft’s offerings are poised to see heightened demand. The combination of a strong product ecosystem, competitive pricing, and innovative AI solutions positions Microsoft as a leader in the technology sector. Consequently, long-term investors should consider using the current stock dip as a buying opportunity, reinforcing their commitment to a company that is not only resilient but also at the forefront of technological advancements.

Frequently Asked Questions

What is Azure and why is it important for Microsoft?

**Azure** is Microsoft’s cloud computing platform. It is important because it helps businesses store data and run applications online, making it a major source of revenue for Microsoft.

How did Microsoft perform in its latest earnings report?

Microsoft reported strong earnings, with revenue exceeding expectations. However, investors were disappointed with **Azure’s slower growth**, which affected the stock price.

What is the significance of AI revenue for Microsoft?

**AI revenue** is very important for Microsoft because it is growing quickly, with an increase of **157%** year-over-year. This shows that more companies are using Microsoft’s AI tools.

Why did Microsoft’s stock decline after the earnings report?

Microsoft’s stock declined because **Azure’s revenue growth** was at the lower end of expectations. Investors wanted higher growth, which did not happen this time.

What is the ‘intelligent cloud’ revenue?

**Intelligent cloud revenue** includes all money made from Azure and related services. It grew by **19%** year-over-year, showing that cloud services are still in demand.

How can investors benefit from Microsoft’s current stock situation?

Investors might find it a good time to buy Microsoft stock because the price has dipped. This can be an opportunity for those looking to invest in a strong tech company for the future.

Summary

Microsoft reported strong fiscal Q2 results, surpassing analyst expectations for revenue and earnings. However, investors expressed disappointment in Azure’s growth, which, although still the company’s key growth driver, was at the lower end of guidance with a 31% increase, down from 33%. Despite this, overall intelligent cloud revenue rose 19% to $25.5 billion, with AI-related revenue showing robust performance. Microsoft’s AI business exceeded a $13 billion annual revenue run rate, and the firm anticipates that reducing computing costs will boost consumption. The stock remains attractively priced for long-term investment, reflecting its strong recurring revenue potential.