(The Center Square) â The Illinois Municipal League is warning that eliminating the 1% grocery tax as Gov. J.B. Pritzker proposed will cost local taxpayer-funded cities hundreds of millions a year.

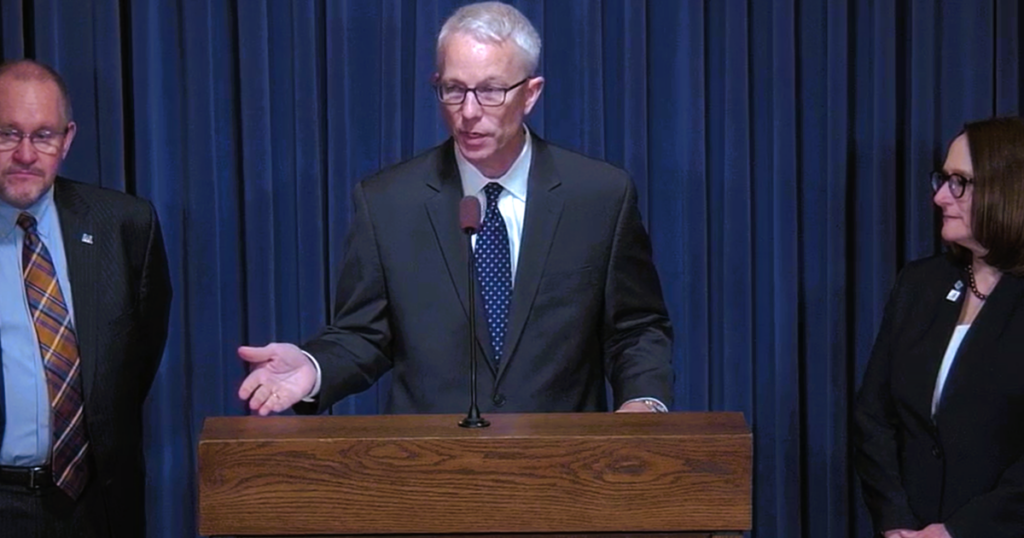

The next budget year begins July 1. Wednesdayâs release of the governorâs proposed $52.7 billion budget keeps the Local Government Distributive Fund flat, something Illinois Municipal League Executive Director Brad Cole contends keeps cities from getting their full share of state income taxes.Â

IML officials advocate for the full 10% rate to be restored, rather than the current level of 6.47% of individual income tax collections and 6.845% of corporate income tax collections.

âThe rate is whatâs important, so if more revenues do come in the rate would apply to that but itâs basically flat,â Cole said.Â

A major element of the governorâs proposal of eliminating the 1% grocery tax will be entirely on the backs of local governments.Â

âThatâs for the rest of time, hundreds of millions of dollars annually impact against local governments,â Cole told The Center Square. âThat grocery tax solely goes to municipalities. There is no state money in there at all. So when the governor offered to reduce that, he eliminated local funding. So, take away three- or four-hundred million dollars, [cities] are going to have to come up with it somehow.âÂ

If cities lose out on such funds, or donât get their share of LGDF, Cole said local taxpayers may be asked to pay higher local taxes to continue vital city services. Â

One element of the governorâs proposal that could bring more tax revenue into local coffers is a possible cap to the vendor discount for retailers acting as sales tax collectors for state and local governments. The move is opposed by retailers and the Illinois Chamber of Commerce, which called it a stealth tax increase on retailers large and small.Â

Budget documents from the governorâs office indicate capping the sales tax retailersâ discount will bring $101 million to the state and $85 million for local governments. Cole said that wonât offset projected losses from the elimination of the grocery tax.Â

âWeâre talking about ⦠at least $350 million on the elimination of the grocery tax, so if they change the vendor discount, why do we have to give up something else in order to get that?â he asked.Â

Cole said the two items arenât mutually exclusive and itâs possible the grocery tax would be eliminated with retailers being kept whole from the vendor discount cap, which would negatively impact local taxpayer-funded governments. He said that could end up in local tax increases to make up for the difference.Â

Another area of the governorâs plan to transfer funds from transit districts could compound other funding issues for municipalities, Cole said.Â

Legislators are off next week. They return to the capitol March 5. Next yearâs budget must be approved with simple majorities before the end of May.